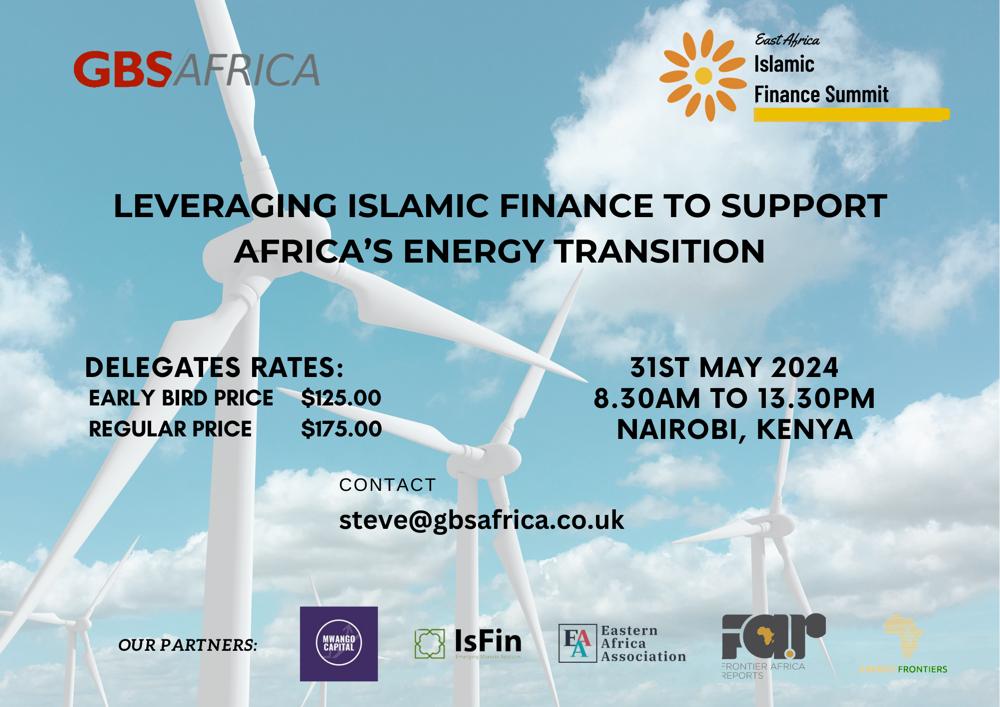

Leveraging Islamic Finance to support Africa's Energy transition to a Net Zero Future.

- Nairobi, Kenya

- 31st May 2024

- 8.30 AM - 13.00 PM

Supporting Africa's transformation towards a greener and more equal energy landscape, Islamic financial solutions, which are based on ethical principles, play a crucial role in addressing climate change and ending energy poverty. The African Continent, especially in countries with populations at risk from climate change, can benefit from Islamic finance's emphasis on social responsibility and the preservation of human life. The sustainable development aspirations of the continent are strongly aligned with the products supplied by Islamic finance.

Introduction:

Africa, a continent with great potential but limited by energy poverty and climate vulnerabilities, faces these issues. The need for sustainable, accessible, and responsible financing solutions has never been more critical. Leveraging the core principles of Islamic finance offers a unique pathway to support Africa's climate transition strategy while addressing the pressing issue of energy poverty. The transition strategy presents an opportunity for growth, innovation, and sustainability.

Background:

Achieving global energy security and environmental sustainability requires an urgent shift away from fossil fuels and towards renewable energy sources. Communities in Africa are more at risk from the effects of climate change, despite the fact that they contribute very little to CO2 emissions. Therefore, this shift is of paramount importance to them.

The energy transition to Net Zero is being impeded by a large financing deficit in Africa, which is estimated at $41.3 billion by UNDP, despite general agreement. Islamic finance is rising as a powerful force for ethical, sustainable investment, and development finance institutions, MDBs, and the private sector all play essential roles in closing this gap. Aligning with the aims of climate financing and sustainable development, it is committed to ethical, socially accountable, and environmentally beneficial operations. One viable option for financing Africa's energy transformation is Islamic finance, which prioritises tangible assets, prohibits interest (riba), and is based on the principles of risk-sharing.

Join GBS Africa and our partners for a thought leadership discussion taking place on May 31, 2024, from 8:30 a.m. to 1300 p.m., on the margins Africa Development Bank Annual General Meetings. The Radisson Blu Hotel in Nairobi is the venue for this.

This session is designed to bring together influential stakeholders from both the government and private sectors, featuring a lineup of expert speakers who will share their invaluable insights and diverse experiences from across different regions. These gatherings promise to facilitate a dynamic exchange of knowledge and innovative strategies aimed at promoting collaboration towards a climate change transition strategy.

Discussion Points:

Bridging the Climate Finance Gap with Islamic Finance: Highlight how Islamic financial instruments, like Sukuk, can revolutionise funding for renewable energy in Africa with case studies on successful green project financing and strategies for adapting these models to local contexts.

Combating Energy Poverty: Discuss the role of Sharia-compliant financing in supporting small-scale renewable energy projects and off-grid solutions to improve energy access and foster socioeconomic development across the continent.

Groundbreaking Islamic Financial Models: Investigate the evolution of Green Sukuk and other Islamic financial instruments tailored to environmental and climatic projects, with a focus on the role of norms and frameworks in enabling long-term investment.

Public-Private Partnerships (PPPs): Examine how PPPs can leverage Islamic finance for climate action, focusing on risk-sharing mechanisms and attracting private sector investment, with examples of successful collaborations in the Islamic finance sector.

Legal and Regulatory Frameworks: Working with regulators to create strong legal and regulatory frameworks to help the growth of Islamic finance in Africa. These frameworks should support the creation of Sharia-compliant financial products and make it easier for people to invest in climate- and sustainability-related projects.

Click here to register